HMS Networks AB (publ) (“HMS”), a global provider of industrial information and communication technology, has today entered into a binding agreement with DOGAWIST-Investment GmbH to acquire 100% of the shares in PEAK-System Technik GmbH (“PEAK-System”), a well-established German provider of industrial communication solutions.

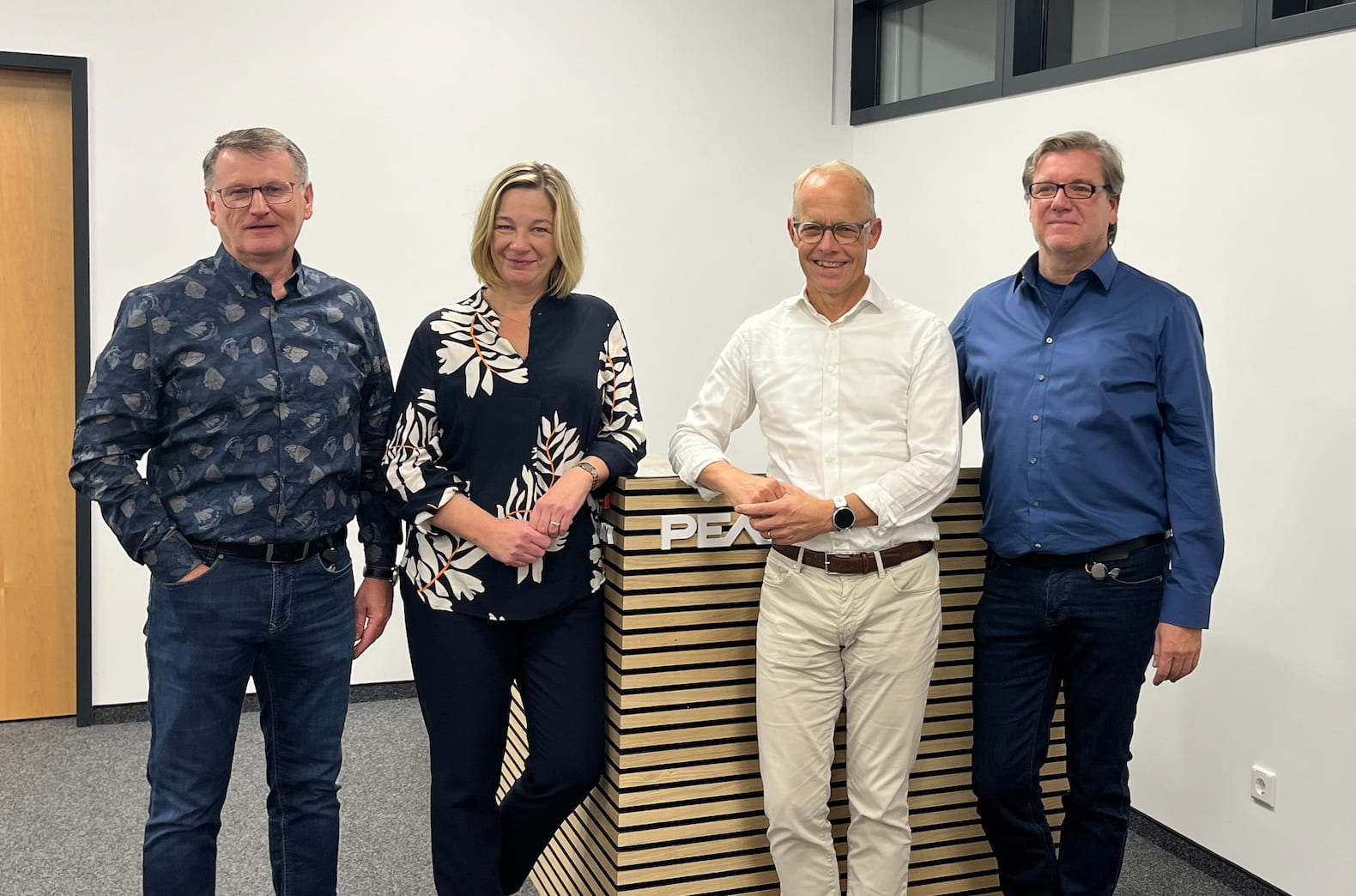

At the PEAK-System office in Darmstadt after signing. From left: Alexander Gach, Managing Director PEAK-System Technik, Ines Dohmann, Managing Director PEAK Group, Staffan Dahlström, CEO of HMS Networks and Uwe Wilhelm, Managing Director PEAK Group and PEAK-System Technik.

Summary of the acquisition

PEAK-System at a glance

PEAK-System is a well-established German industrial communication company offering both hardware and software for industrial and automotive communication. Through the development and manufacturing of innovative and scalable products with emphasis on network technologies used in the automotive industry, the company has been serving customers all over the world since the start in 1999.

PEAK-System’s headquarters, with product manufacturing and development, is located in Darmstadt, Germany. There is also a French subsidiary with an office in Maxéville, close to Nancy, France. PEAK-System employs in total about 50 people.

The sales are well distributed over the key industrial communication markets with approximately 50% of sales in Europe, 25% in Asia, and 25% in the US.

Strategic rationale

The acquisition will strengthen HMS’ position within communication solutions for advanced engineering tools, testing and control within automotive, medical and transportation. HMS sees several synergies between HMS’ Business Unit Ixxat and PEAK-System, both when it comes to product development and cross-selling, utilizing the sales channels of both companies. The acquisition will strengthen HMS’ global presence within automotive communication, especially in the important German market.

“PEAK-System’s extensive product portfolio and expertise expand our existing product offering in communication solutions for advanced engineering tools, testing and control in applications within automotive, medical and transportation. We also see excellent cross-selling opportunities, both geographically and technically. Our Ixxat brand and PEAK-System already offer unique sets of software and hardware tools and together, they will provide our customers with more options to solve their communications challenges. This is an exciting step for HMS and our Ixxat brand and the entire HMS team are happy to welcome our new colleagues at PEAK-System to HMS,” says Staffan Dahlström, CEO of HMS Networks.

Financial implications and financing

In the twelve-month period ending on September 30, 2024, PEAK-System reported sales of about EUR 25 million and an adjusted EBITDA-margin of about 30%2. Transaction- and integration costs are expected to be around SEK 10 million, with impact on 2024 and 2025.

The acquisition will be financed through a combination of existing financing arrangements and a new term loan of EUR 30 million provided by Skandinaviska Enskilda Banken AB (Publ) and the Swedish Export Credit Corporation (Sw. AB Svensk Exportkredit).

The transaction is expected to close on November 1st and is expected to be accretive to HMS' earnings per share from completion of the acquisition (excluding any non-cash amortization impacts from the transaction).

For more information, please contact:

Staffan Dahlström, CEO HMS, +46 (0)35 17 29 01

Joakim Nideborn, CFO HMS, +46 (0)35 710 69 83

This information is such that HMS Networks AB (publ) is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 14:35 CEST on October 1, 2024.

HMS Networks AB (publ) is a market-leading provider of solutions in Industrial Information and Communication Technology (Industrial ICT) and employs over 1 200 people. Local sales and support are handled through over 20 sales offices all over the world, as well as through a wide network of distributors and partners. HMS reported sales of SEK 3,025 million in 2023 and is listed on the NASDAQ OMX in Stockholm in the Large Cap segment and Telecommunications sector.

1 To be determined in SEK upon closing

2 The EBITDA numbers have been adjusted to reflect how the PEAK-System business would, on a preliminary and indicative basis, be reported in the HMS group. The financial information presented herein refers to unaudited figures. The adjusted EBITDA excludes any potential synergies, transaction costs and integration costs from the acquisition.

Attachment