Every year, HMS Networks analyzes the industrial network market to estimate the distribution of new connected nodes in factory automation. This year’s study shows that the industrial network market is expected to grow by 7% in 2023.

Every year, HMS Networks analyzes the industrial network market to estimate the distribution of new connected nodes in factory automation. This year’s study shows that the industrial network market is expected to grow by 7% in 2023.

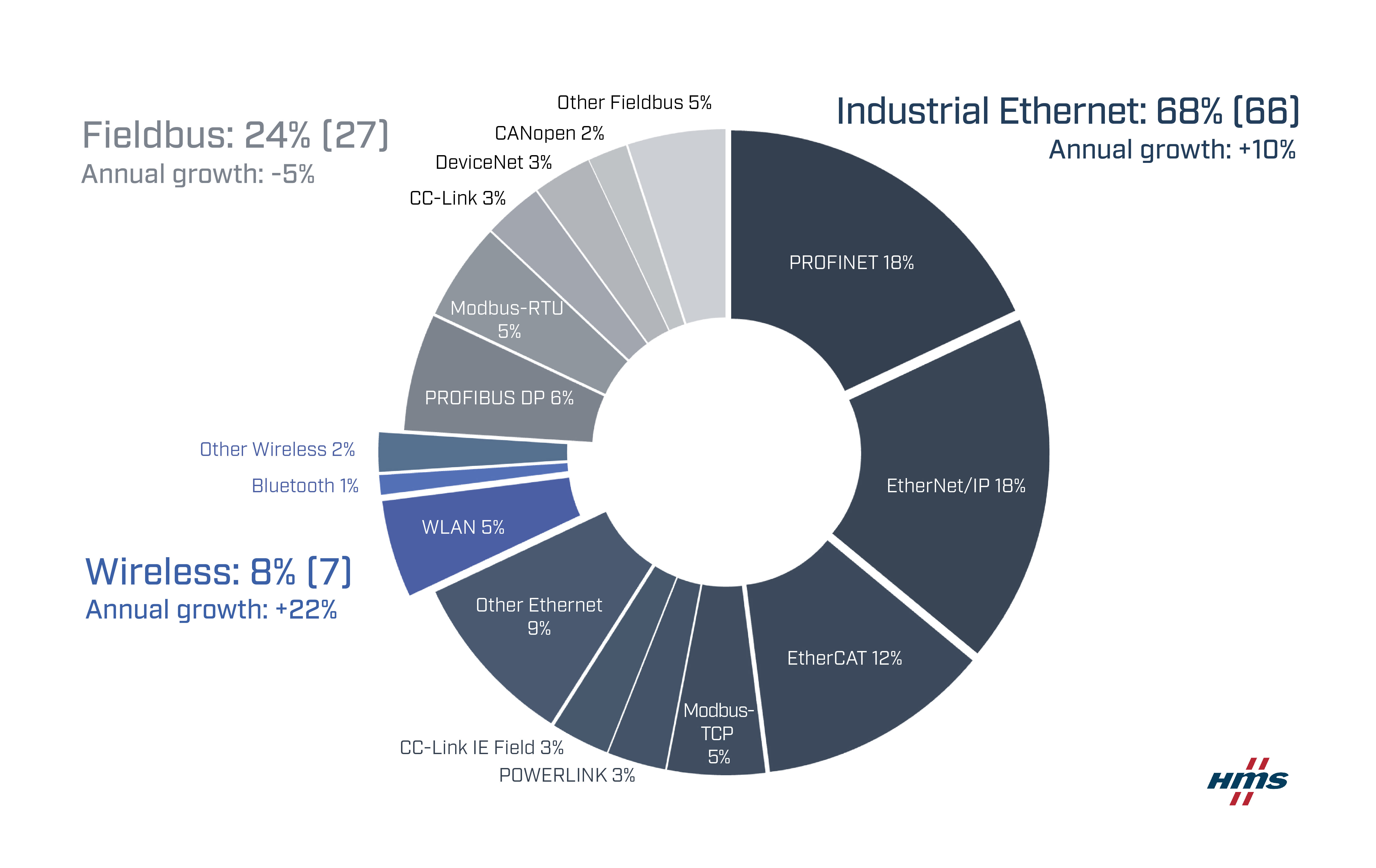

Industrial Ethernet still shows the highest growth and now accounts for 68% of all new installed nodes (66% last year). Fieldbuses decline to 24% (27) while wireless grows to 8% market share (7% last year). PROFINET and EtherNet/IP share first place in the network rankings with 18% market share followed by the strong contender EtherCAT now at 12%.

In the 2023 study, HMS concludes that the industrial network market continues to grow and that the total market growth in 2023 is expected to be +7%, confirming the continued importance of network connectivity in factories.

Growing by 10%, Industrial Ethernet continues to take market share. Industrial Ethernet now makes up for 68% of the global market of new installed nodes in factory automation (compared to 66% last year). The head-to-head battle between PROFINET and EtherNet/IP continues as they lead the 2023 network rankings with 18% market share each, but EtherCAT also continues to grow strongly and is now in an unthreatened third place at 12% market share.

Last year’s growth for Fieldbuses was temporary as new fieldbus installations decline with -5% in 2023. PROFIBUS leads the fieldbus rankings with 6% market share, but not with much as Modbus-RTU is close behind at 5%.

Together, fieldbuses account for 24% (27) of the market in 2023. Although the number of new fieldbus nodes are declining, a lot of devices, machines and factories will still be relying on the well-functioning and proven fieldbuses for many years to come.

The Wireless growth accelerates to +22% in 2023, as more wireless industrial networking solutions are introduced in factory automation. Typical use cases include cable replacement applications, wireless machine access and connectivity to mobile industrial equipment.

“Solid industrial network connectivity is key to achieve the manufacturing uptime which is needed to reach productivity and sustainability objectives in factory automation,” says Magnus Jansson, Product Marketing Director at HMS Networks, Business Unit Anybus. “Quality, security, safety, and gaining insights through device and machine data, are key drivers we see for the continued expansion of industrial networking.

EtherNet/IP, PROFINET and EtherCAT are leading in Europe and the Middle East with PROFIBUS and Modbus-TCP as runners up. The U.S. market is dominated by EtherNet/IP with EtherCAT developing strongly and gaining market share. PROFINET leads a fragmented Asian market, followed by EtherNet/IP and strong contenders CC-Link/CC-Link IE Field, EtherCAT, PROFIBUS, and Modbus (RTU/TCP).

The study includes HMS’ estimation for 2023 based on number of new installed nodes within Factory Automation. A node is defined as a machine or device connected to an industrial field network. The presented figures represent HMS’ consolidated view, considering insights from colleagues in the industry, our own sales statistics and overall perception of the market.